Why Restraint in Presenting Competitive Research is More Important Than You Think

March 12, 2019Finding the true clarity of the quality of information and research your company needs to succeed.

One of the things people struggle with is determining whether any given bit of information is credible, both on its own, and in comparison to, corroborating or conflicting information.

At Tyson Heinz, we have developed a list of qualities, and a sort of checklist, to remind ourselves of what to look for to gauge research credibility. Similar to when a jeweler evaluates a diamond (using the 4 “C”s – carat, cut, color, and clarity), we can also use a set of qualities to aid our thinking about the quality of intelligence information.

The key qualities to look at when evaluating the credibility of a piece of intelligence information:

- Currency: How timely is the information?

- Reliability: How reliable is the source of the information? Is that source known to provide accurate information?

- Authority: How close is the source to genuine knowledge (e.g., first-hand experience)? (Second-hand information, by the way, is almost never authoritative. If the person wasn’t there, they can’t be sure of what happened.)

- Subjectivity: Does the source have a particular bias?

- Provenance: What method was used to gather the information? Could the method have an influence on the information itself?

- Context: How does the information connect with other bits of relevant information?

How these elements interact

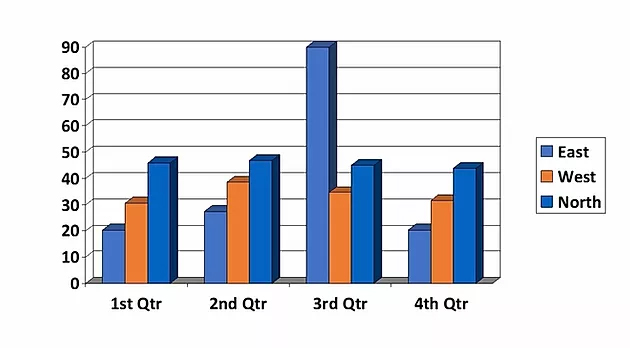

A CEO tends to be a very authoritative source about the company’s strategy, but is often times less reliable (since a part of their role is to manage the flow of information to capital markets). So, we would call information provided by the CEO during a quarterly analyst’s call current and authoritative, but likely less reliable, less objective, and more biased.

Reliability

That said, information is really only reliable when it has been confirmed and validated by multiple different sources with multiple perspectives. One piece of information is an anecdote, two pieces is a coincidence, and three points starts a trend. Trends point towards conclusions. While evaluating all of the inputs is only the first step in analysis, we find this list of questions helps organize that process.